Liquidity, Open Interest, Block reward

“Unlocking the Secrets of Crypto Markets: A Guide to Cryptocurrency’s Key Metrics”

In the ever-evolving landscape of cryptocurrency markets, several key metrics play a crucial role in determining the overall health and direction of an asset’s price movement. In this article, we’ll delve into three essential metrics that have significant implications for investors and market participants: liquidity, open interest, and block reward.

Liquidity

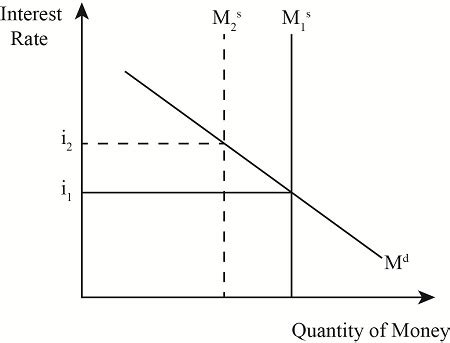

Liquidity refers to the ease with which an investor can buy or sell a particular cryptocurrency without significantly affecting its price. High liquidity is essential for all types of investments, as it allows traders to quickly convert their holdings into cash if needed. In the context of cryptocurrencies, high liquidity enables investors to take advantage of market fluctuations, making it easier to profit from price movements.

Several factors contribute to liquidity in cryptocurrency markets:

- Trading volumes: Higher trading volumes indicate a greater demand for the asset, which can lead to increased liquidity.

- Order book depth

: A deep and active order book reflects the level of confidence investors have in the asset’s price, contributing to its overall liquidity.

- Support and resistance levels: The presence of specific price levels that traders are willing to buy or sell at can increase liquidity.

To measure cryptocurrency liquidity, traders often use metrics like:

- Order book depth: The number of open orders divided by the total market capitalization.

- Open interest: The number of outstanding contracts multiplied by the current spot price.

Open Interest

Open interest (OI) is a key metric that measures the number of outstanding contracts for an asset on a particular exchange. It represents the amount of contracts that have been traded but not settled yet, providing insight into market sentiment and volatility.

The open interest metric has several implications:

- Market sentiment: A high open interest often indicates a bullish or bearish market atmosphere.

- Volatility: Changes in OI can signal increased trading activity and market uncertainty.

- Price movements: An increase in OI can lead to higher prices as investors are more willing to buy into the asset.

To calculate open interest, traders typically use the following formula:

OI = Total outstanding contracts \* Current spot price

Block Reward

The block reward is a significant component of cryptocurrency mining rewards that incentivizes network participants to contribute computational power to validate transactions and secure the network. The block reward is calculated using a formula that takes into account the total supply of an asset, its block reward rate (which decreases over time), and the number of blocks mined in a given period.

The block reward has several implications:

- Mining profitability: The block reward affects miners’ revenue streams, making it more challenging to maintain profitability.

- Incentivizing adoption: Increasing the block reward can encourage more users to participate in the network, leading to increased demand and higher prices.

- Network security: Reducing the block reward can help prevent centralization of mining power, promoting a more decentralized network.

To calculate the block reward, traders typically need:

- The total supply of an asset

- The number of blocks mined in a given period

- The block reward rate (which can be found on the asset’s official website or through market research)

By understanding and analyzing these three key metrics – liquidity, open interest, and block reward – investors and traders can make more informed decisions about their cryptocurrency investments.