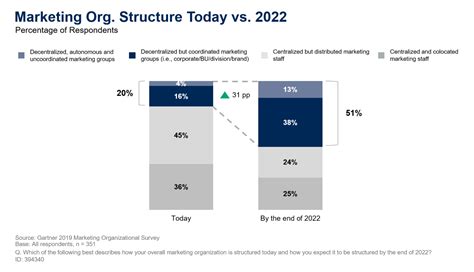

Market research, profit taking, decentralization

Decentralized Finance (DeFi) and Cryptocurrency Market Research: A Guide to Successful Trading

The world of cryptocurrency trading is vast and complex, with numerous decentralized finance (DeFi) platforms, cryptocurrencies, and market research tools available. In this article, we will delve into the world of DeFi and provide an overview of how you can conduct effective market research, identify profitable strategies, and profit from your trades.

What is Decentralized Finance (DeFi)?

Decentralized finance refers to a network of financial services powered by blockchain technology. DeFi platforms aim to reduce or eliminate the need for intermediaries such as banks and provide users with access to a wide range of financial services without the need for traditional payment systems.

Benefits of Using Crypto Market Research Tools

Crypto market research tools can help you stay on top of market trends, make more informed trading decisions, and achieve your investment goals. Some of the benefits of using crypto market research tools include:

- Real-time data: Access real-time market data, including price movements, trends, and trading volumes.

- Automated analysis: Automated analysis tools can help identify profitable strategies, predict market movements, and optimize trading portfolios.

- Risk management: Risk management tools can help you set stop losses, limit risk, and diversify your portfolio.

Take Profit Strategies

When it comes to making a profit from cryptocurrency trading, the key is to set a clear goal and stick to it. Some popular profit strategies include:

- Stop-Loss Orders: Place a stop-loss order above or below the current price to limit potential losses.

- Take-Profit Orders: Set a profit order at a predetermined price to lock in when the market reaches that level.

- Risk-Reward: Use the risk-reward ratio to set a percentage of potential return relative to the amount of risk.

Decentralized Finance (DeFi) Platforms

Decentralized finance platforms offer a wide range of financial services, such as lending, borrowing, trading, and staking. Some popular DeFi platforms include:

- Uniswap: A liquidity pool platform that allows users to trade cryptocurrencies directly.

- Aave: A lending platform that offers high interest rates on deposits.

- Curve Finance: A stablecoin platform that offers hedging and lending services.

Best Practices for Crypto Market Research

Follow these best practices to achieve success in the world of cryptocurrency trading:

- Stay informed: Stay up to date with market news, trends, and developments.

- Use multiple sources: Use a combination of reputable sources to stay up to date with market information.

- Set clear goals: Set specific, measurable, achievable, relevant, and time-bound (SMART) goals for your trading portfolio.

- Diversify: Diversify your portfolio by investing in a variety of cryptocurrencies, assets, and strategies.

In summary, the world of cryptocurrency trading is complex and rapidly evolving. By using crypto market research tools, implementing effective winning strategies, and staying up to date with market developments, you can achieve success in this exciting and dynamic industry.